Good Corporate Governance Practice

Corporate Governance Report

The Corporate Governance (CG) is a set of guidelines and recommended rules prepared by Estonian Financial Supervision and Resolution Authority, which is intended to be observed mainly by publicly traded companies. Tallinna Kaubamaja Group follows largely the Corporate Governance Code despite their indicative nature. Below is a description of the management principles of Tallinna Kaubamaja Group and general meetings held in 2023, and justification is given in the events when some clauses of the

Code are not followed.

General meeting

Exercise of shareholders’ rights

The general meeting of shareholders is the highest governing body of Tallinna Kaubamaja Group. The annual general meeting is held once a year and extraordinary general meetings may be convened by the Management Board in the events prescribed by law. The general meeting is competent to change the articles of association and share capital, elect members of the Supervisory Board and decide on their remuneration, appoint an auditor, approve the annual report and allocate profit, as well as decide on

other matters stipulated by the articles of association and laws.

As far as the Group is aware, no agreements have been concluded between shareholders regarding the coordinated exercise of shareholder rights.

Convening the general meeting and disclosures

Tallinna Kaubamaja Group published a notice convening the general meeting through information system of the Nasdaq Tallinn Stock Exchange as well as on its website on 21st of February 2023 and through a daily newspaper Eesti Päevaleht on 22nd of February 2023. The Group enabled its shareholders to ask questions on the topics specified in the agenda by using the e-mail address and phone specified in the notice, and to get acquainted with the annual report, the sworn auditor’s report, the profit distribution proposal, the supervisory board’s report, the introduction of the new supervisory board member andidate and the draft decisions on its website and in its office at Kaubamaja 1, Tallinn, starting from 22nd of February 2023.

The general meeting of shareholders of Tallinna Kaubamaja Group was held in the Viking Motors dealership at Tammsaare tee 51, Tallinn, on 17th of March 2023 beginning at 2pm. The resolutions made at the general meeting are published in the information system of NASDAQ Tallinn Stock Exchange and on the website of Tallinna Kaubamaja Group.

Holding of the general meeting

A general meeting can adopt resolutions if over one-half of the votes represented by shares are present. A resolution of general meeting is adopted if over one-half of the votes represented at the meeting are in favour unless a larger majority is required by law.

The general meeting of Tallinna Kaubamaja Group must take part in person or on the basis of authorization and, in accordance with the articles of association, the general meeting may adopt resolutions if the general meeting is attended by shareholders who hold more than half of the votes represented by shares. At the general meeting held on 17th of March 2023, shareholders were able, in order to exercise their shareholder’s rights, to forward their vote to the public limited company before the general meeting, at least in a format which could be reproduced in writing or with a digitally signed ballot delivered by e-mail.

The language of the general meeting held in 2023 was Estonian and the meeting was chaired by the general counsel of the Tallinna Kaubamaja Group Helen Tulve. The meeting could also be heard through a webinar. The meeting was attended by Chairman of Supervisory Board Jüri Käo, Management Board member Raul Puusepp, candidate for member of the Supervisory Board Kristo Anton, board members of subsidiaries Erkki Laugus (Kaubamaja AS), Anne-Liis Ostov (TKM Beauty OÜ, TKM Beauty Eesti OÜ), Jüri Kuusk (Viking Motors AS, TKM Auto OÜ); members of the Supervisory Board and auditors took part in the meeting through the webinar. 71.44% of the votes represented by shares were present at the general meeting. At the general meeting, allocation of profit was discussed as a separate topic and a separate resolution was adopted with regard to it.

In addition to the approval of the annual report and distribution of profits, Supervisory Board member Andres Järving was recalled and Kristo Anton was elected as a new member of the Supervisory Board. It was decided to pay the new member of the Supervisory Board 2,000 euros per month, similarly to the other members of the Supervisory Board (Enn Kunila, Gunnar Kraft, Meelis Milder).

Considering the aforementioned descriptions of general meetings held in 2023, the Group has complied with the Corporate Governance Code in informing the shareholders, convening and holding the general meeting.

Management Board

The Management Board is a governing body of Tallinna Kaubamaja Group that represents and directs the Group on a daily basis. In accordance with the articles of association, the Management Board may have one to six members. In accordance with the Commercial Code, members of the Management Board of Tallinna Kaubamaja Grupp AS are elected by the Supervisory Board. The member of the Management Board of Tallinna Kaubamaja Group is selected on the basis of gender neutrality and evaluating the actual competence of the persons. In order to elect a member of the Management Board, his or her consent is required. According to the articles of association, a member of the Management Board shall be elected for a specified term of up to three years. Extension of the term of office of a member of the Management Board shall not be decided earlier than one year before the planned date of expiry of the term of office, and not for a period longer than the maximum term of office prescribed by the articles of association. Currently, the Management Board of Tallinna Kaubamaja Grupp AS has one member.

The Management Board member of Tallinna Kaubamaja Group is Raul Puusepp, whose term of office

was extended on 17th of February 2023, and his mandate will expire on 5th of March 2026. Raul

Puusepp graduated from the University of Tartu in 1993 with a degree in applied mathematics. In 2000-

2002, Raul Puusepp was the Chairman of the Management Board of AS Tartu Kaubamaja. He has

previously worked as the head of the Southern Region of AS Leks Kindlustus and as the project

manager of AS Eesti Post. Raul Puusepp participates in the work of all Estonian subsidiaries of

Tallinna Kaubamaja Grupp AS and the supervisory boards of Verte Auto SIA, SIA TKM Latvija and UAB

TKM Lietuva, including Selver AS, Viking Security AS, TKM Finants AS, AS Walde and OÜ TKM Beauty

as the Chairman of the Supervisory Board.

The duties and remuneration of the Chairman of the Management Board are specified in the board member contract concluded with the Chairman, in which the Group was represented by the Chairman of the Supervisory Board. In accordance with the contract and in accordance with the remuneration principles of the Board Members approved at the General Meeting, the Chairman of the Management Board is paid a membership fee and he may receive performance pay once in a year accordance with the specific, comparable and predefined objectives of the Group’s economic results for the previous year. The Management Board member of the Group has no additional bonuses or benefits. In 2023, the total remuneration of the Chairman of the Board (gross fee, on accrual basis) amounted to 333.2 thousand euros (in 2022 278 thousand euros), including calculated performance fees (gross fee, on accrual basis) of 195.6 thousand euros (in 2022 174.3 thousand euros). The issuer’s costsinclude, in addition to accrual-based charges, the social tax costs according to the rate established by law. A more detailed overview of the remuneration paid in accordance with the remuneration principles of the issuer’s manager is available in the remuneration report.

Unlike clause 2.2.1 of the Corporate Governance Code, the Management Board of Group consists of one member. It is a historical tradition, but besides to the member of the Management board, the management team of the Group includes, a CFO, Legal Director, IT Director and Marketing Director. All the important resolutions are adopted by the Management Board and the management team in collaboration with the Supervisory Board of the company. Under the direction of the Tallinna Kaubamaja

Grupp, close cooperation is carried out with the leaders of subsidiaries and the people responsible for respective areas. The Group believes that such a division protects the best the interests of all shareholders and ensures sustainability of the Group. Significant transactions with the Group that are concluded with a member of the Management Board, or a person close to or related to him or her are decided and determined by the Group’s Supervisory Board. No such transactions occurred in 2023 or 2022. There were also no conflicts of interest during these periods.

Supervisory Board

The Supervisory Board plans the activities of Group, organises its management and supervises the activities of the Management Board in the period between the meetings of shareholders. The Supervisory Board notifies the general meeting of the result of such supervision. The Supervisory Board decides on the development strategy and investment policy of the Group, conclusion of real estate transactions, adoption of the investment budget and annual budget prepared by the Management Board. The

meetings of the Supervisory Board are regularly held once a month and additionally extraordinary if necessary.

In 2023, 12 scheduled meetings and 1 extraordinary meeting of the Supervisory Board were held and in 2022, 12 scheduled meetings and 1 extraordinary meeting was held. In 2023, all members of the Supervisory Board attended all meetings of the Supervisory Board.

The Supervisory Board has three to six members according to the resolution of the general meeting and the member is elected for up to three years. The work of the Supervisory Board is organised by the Chairman of the Supervisory Board.

By the resolution of the general meeting held on 19th of March 2021, Andres Järving, Jüri Käo, Enn Kunila, Meelis Milder (an independent Supervisory Board Member) and Gunnar Kraft (an independent supervisory Board Member) were elected as the members of the Supervisory Board. By the resolution of the general meeting held on 17th of March 2023, Supervisory Board member Andres Järving was recalled and Kristo Anton was elected as a new Supervisory Board member, whose powers are valid until 16th of March 2026. The mandates of the remaining members of the Supervisory Board will expire on 20th of May 2024. Changes in the composition or the extension of the powers of the Supervisory Board of Tallinna Kaubamaja Grupp AS will be decided by the next ordinary general meeting of shareholders (in the first quarter of 2024).

Jüri Käo continued as the Chairman of the Supervisory Board, he has been a member of the Supervisory

Board of Tallinna Kaubamaja Group from 1997 and has been a Chairman of the Supervisory Board

continuously since 2009. He has also been a Chairman of the Supervisory Board in 2000-2001. Jüri Käo

works as the Chairman of the Management Board of OÜ NG Investeeringud and participates in the work

of all Estonian subsidiaries of Tallinna Kaubamaja Grupp AS and the supervisory boards of UAB TKM

Lietuva and SIA TKM Latvija. He is the Chairman of the Supervisory Board of Kaubamaja AS and a

member of the Audit Committee of Tallinna Kaubamaja Grupp AS. He is also the Chairman of the

Supervisory Board of Kitman Thulema AS, a member of the NG Investeeringud group of companies, and

a Member of the Supervisory Board of AS Liviko, AS Balbiino, OÜ Roseni Kinnisvara, Roseni Majad OÜ,

OÜ Kitman Coldtech, OÜ NG Logistics and Kuulsaal OÜ.

Enn Kunila has been elected by the shareholders as a member of the Supervisory Board of Tallinna

Kaubamaja Grupp AS since 2000. Enn Kunila works as a member of the Management Board of OÜ NG

Investeeringud and participates in the supervisory boards of all Estonian subsidiaries and affiliates of

Tallinna Kaubamaja Grupp AS, UAB TKM Lietuva and SIA TKM Latvija, including being the Chairman of

the Supervisory Board of TKM Kinnisvara AS, TKM Kinnisvara Tartu OÜ, SIA TKM Latvija and UAB TKM

Lietuva. He is the Chairman of the Supervisory Board of members of the NG Investeeringud group of

companies AS Liviko, AS Balbiino, OÜ Roseni Kinnisvara, Roseni Majad OÜ, Kuulsaal OÜ and a member

of the Supervisory Board of Kitman Thulema AS, OÜ Kitman Coldtech, OÜ NG Logistics.

Kristo Anton holds a master’s degree (MBA) from Concordia International University Estonia since 2001

and a master’s degree (MScEng) from Tallinn University of Technology since 2022. Kristo Anton has

been working as the Investment Manager of NG Investeeringud OÜ since 2006. Kristo Anton is also a

member of the sustainable development working group of Tallinna Kaubamaja Grupp AS and a member

of the Audit Committee. As of 1st of January 2023, Kristo Anton participates in the work of the

Supervisory Boards of Estonian subsidiaries of Tallinna Kaubamaja Grupp AS and SIA Forum Auto, SIA

Verte Auto, UAB Motus auto, SIA TKM Latvija, UAB TKM Lietuva.

Meelis Milder has been elected by the shareholders as a Member of the Supervisory Board of Tallinna

Kaubamaja Grupp AS since 1997 and participates in the work of the Supervisory Board of Kaubamaja

AS. Meelis Milder graduated from the Faculty of Economics of the University of Tartu, worked as a

management consultant in Mainor and was a long-term Chairman of the Board of AS Baltika. In the years

2021-2023, Meelis Milder managed the AS Wendre.

Gunnar Kraft has been elected by the shareholders as a Member of the Supervisory Board of Tallinna

Kaubamaja Grupp AS since 2004 and participates in the work of the Supervisory Board of Kaubamaja

AS and the Audit Committee of Tallinna Kaubamaja Grupp AS. Gunnar Kraft graduated from the Tallinn

Polytechnic Institute as an economic engineer and obtained a master’s degree in international business

management from the University of Helsinki. From 1992 to 2002, he worked as the Vice President of AS

Eesti Investeerimispank, as the Chairman of the Supervisory Board of AS Optiva Pank and as the Director

of Baltic Banking at Sampo Pank PLC. From 2002 to 2014, he was the Chairman of the Management

Board of AS Sangar, and from 2015 to 2022 Chairman of the Supervisory Board. He is also a member of

the Supervisory Board of AS Mivar-Viva.

Members of the Group’s Supervisory Board Jüri Käo and Enn Kunila are members of the Management Board of the shareholder OÜ NG Investeeringud, which holds a significant stake in the Group. The independent members of the Supervisory Board are Meelis Milder and Gunnar Kraft, who do not have any commercial, family or other links with the Group, the company controlled by it, the controlling shareholder of the Group, the company belonging to its Group or the members of the management bodies of those companies which could influence their decisions due to a conflict of interest. Meelis Milder is a member of the Group’s Supervisory Board since 1997 and Gunnar Kraft since 2004, so these persons do not fully meet the independence characteristics set out in the Estonian Financial Supervision and Resolution Authority’s guide, but the Group highly values the contribution and knowledge of both Supervisory Board members. According to the Group, the long-term participation of the members of the

Supervisory Board as a member of the Supervisory Board does not affect their independence but, on the contrary, their competence is enhanced.

According to the decision of the annual general meeting held on 19 March 2021, the monthly remuneration of the Supervisory Board member of Tallinna Kaubamaja Grupp AS is 2,000 euros; the Chairman of the Supervisory Board receives 2,400 euros monthly. In 2023, the remuneration of the members of the Supervisory Board of Tallinna Kaubamaja Group in the total amount of 120 thousand euros has been calculated, including 29 thousand euros for the Chairman of the Supervisory Board (125

thousand euros in 2022, including 29 thousand euros for the Chairman of the Supervisory Board). The issuer’s costs include, in addition to accrual-based charges, the social tax costs according to the rate established by law.

Cooperation between the Management Board and Supervisory Board

The Management Board and Supervisory Board closely collaborate to achieve the purpose of better protection of the interests of Tallinna Kaubamaja Group. The Management Board, the management team and the Supervisory Board jointly participate in development of the strategy of the Group. In making management decisions, the Management Board and the management team are guided by the strategic instructions supplied by the Supervisory Board.

The Management Board regularly notifies the Supervisory Board of any important circumstances concerning the planning and business activities of the Group’s activities, and separately draws attention to any important changes in the business activities of Tallinna Kaubamaja Group. The Management Board submits the information, including financial statements to the Supervisory Board, in advance before the holding of a meeting of the Supervisory Board. Management of the Group shall be based on the legislation, articles of association, resolutions of meetings of shareholders and Supervisory Board, and the set objectives.

Changes in Articles of Association

Amendments to the articles of association shall be made in accordance with the Commercial Code, under which a resolution on amending the articles of association is adopted if at least 2/3 of the votes represented at a general meeting of shareholders are in favour, unless a larger majority is required by articles of association. The articles of association of Tallinna Kaubamaja Grupp AS do not provide for a larger majority requirement. A resolution on amending the articles of association shall enter into

force as of the making of a respective entry in the commercial register.

Shareholders with a significant shareholding

As of 31.12.2023 the share capital of Tallinna Kaubamaja Group in amount of 16,291,680 euros consists of 40,729,200 registered shares, each with the nominal value of 0.40 euros. All issued shares have been paid.

The shareholder with a significant shareholding is OÜ NG Investeeringud owning 67.05% of the Group’s shares.

Shares granting special rights to their owners and would lead to unequal treatment of shareholders in voting, have not been issued.

Disclosure of information

Group treats all shareholders equally and notifies all shareholders of important circumstances equally, by using its own website as well as the information system of the Nasdaq Baltic Stock Exchange.

Group’s website www.tkmgrupp.ee contains contact information of the Group and key employees, press releases and reports. The annual and interim reports include information on the strategy and financial results of the Group as well as the Corporate Governance Report. Along with the annual report, the Supervisory Board’s written report on the annual report referred to in § 333 (1) of the Commercial Code shall be made available to shareholders on the Group’s website. In the subsection of Market News,

information is disclosed with regard to the membership of the Supervisory Board and auditor, resolutions of the general meeting, and other important information.

Financial reporting and auditing

It is the duty of the Executive Board of Tallinna Kaubamaja Group to organise the internal control and risk management of the Group in a manner that ensures the accuracy of the published financial reports. Each year, the Group publishes the consolidated audited annual reports and quarterly interim reports consolidated during the financial year, which have been disclosed through the NASDAQ Tallinn Stock Exchange information system and are publicly available on the Group’s website. In addition to the disclosed financial reports, management information is gathered in symbiosis with high-quality and accurate financial indicators, and management reports are prepared to ensure adequate governance of the Group’s companies.

The purpose of the internal control and risk management systems connected with the financial reporting process is to ensure harmonised and trustworthy reporting of the Group’s financial performance in conformity with the applicable laws, regulations, adopted accounting policies and the reporting principles approved by the Group. The principles of risk management have been defined in the Group’s risk management framework, which describes the more important activities for risk management relating to identification, assessment, prioritisation and mitigation of risks and the definitions, roles and areas of responsibility related to the field. In addition, the risk management and internal control activities are organised with the work organisation rules of the Group and its subsidiaries, which describe the functioning of various processes.

The Group’s financial area together with accounting and management reporting is the area of responsibility of the Group’s chief financial officer (CFO) being responsible for the identification and assessment of risks in financial reporting, arranging the principles in relation to financial reporting, organises the tools that are required for accounting and reporting and prepares the officially published financial reports of the Group. The financial reporting processes and systems are developed on a

continuous basis. Risk analysis is conducted annually. This risk analysis serves as a basis for the further development of supervision and control measures and checkpoints in reporting to prevent the realisation of risks. The Group’s internal audit supervises the operation of the internal control system, including, among other things, financial reporting processes. The Group’s accounting, funding, IT administration and insuring have been centralised.

On 18 June 2019, the European Commission Delegated Regulation (EU) 2018/8151 entered into force, in accordance with which issuers whose securities are admitted to trading on a regulated market in a Member State of the European Union, shall publish consolidated financial statements in the European Single Electronic Format (ESEF) as from 1 January 2021.

The Group’s financial processes and reports are subject to an annual financial audit, conducted generally by an auditor selected by the Supervisory Board as a result of a competition and approved by the general meeting. Auditors are appointed to perform a single audit or for a specific term. The procedure for remuneration of auditors shall be determined by the Management Board. Along with the resolution of the general meeting from 2022, the financial auditor of the financial year 2023 was AS PricewaterhouseCoopers (PwC). The agreement entered into with the auditor complies with the requirements of the CGR. In 2023, the Group’s contractual auditor, AS PricewaterhouseCoopers, did not provide any other services in addition to auditing the consolidated annual report and the audit of the subsidiary companies’ annual reports. The total amount of fees paid or payable for audit services provided by the Group’s contractual auditor in 2023 is 81 thousand euros, including 32 thousand euros for the consolidated financial statement. In addition, the Group has purchased a training service from the

parent company.

In 2023, the auditor participated in the ordinary general meeting of shareholders, where the 2022 consolidated annual report was approved.

In our opinion, the financial audit conducted in 2023 has been in conformity with regulatory provisions, international standards and the set expectations. In 2023, there have been no circumstances of which the auditor would have informed the Supervisory Board, which, in the auditor’s opinion, could affect the work of the council or the management of the Group. In addition, the auditor has not reported a threat to the auditor’s independence or the professionalism of his work.

PwC has introduced the results of the work during the interim audit and for the final audit before issuing the auditor’s report. The independent auditor’s report is presented on pages 96-104.

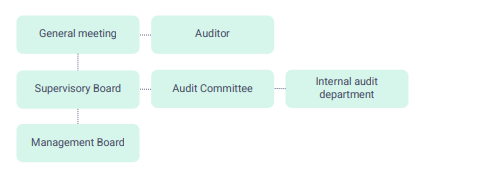

Audit Committee

The Audit Committee is an advisory body established by the Supervisory Board. Task of the Audit Committee is to counsel the Supervisory Board in matters involving accounting, auditing, risk management, internal control and audit, exercising an oversight and budgeting process and legality of the activities.

In order to perform these tasks, the audit committee monitors and analyses the processing of financial information and the process of auditing of annual accounts or consolidated accounts, supervises risk management and evaluates the effectiveness of the internal control system. The audit committee shall make proposals for the appointment and removal of the financial auditors and assess their independence and compliance.

In performing its tasks, the Audit Committee collaborates with the Supervisory Board, the Management Board, internal and external auditors and if necessary, external experts.

In the reporting year, the audit committee consisted of four members, who were Kristo Anton, Gunnar Kraft, Jüri Käo and Kaia Salumets. The chairman of the audit committee is Kaia Salumets.

The Audit Committee prepares an annual summary report about meeting the goals sets in the statutes and presents it to the Supervisory Board.

Based on its duties, the Audit Committee provides ongoing evaluations and makes proposals to the Supervisory Board, the Management Board, the internal audit and/or an external audit provider.

Ten planned Audit Committee meetings were held during the accounting period